Contribution of Virtual Zone Companies to the Country’s Economy 2025

Virtual Zone Association and ICTA: A Path to Collaboration

May 15, 2025

Landmark Ruling: First Full Fine Removal for Virtual Zone Company in Georgia

June 10, 2025We have updated the information on the contribution of Virtual Zone companies with more current data, which highlights the significance of the IT sector for the country’s economy.

Contribution of Virtual Zone Companies

Virtual Zone companies continue to be a vital source of economic growth in Georgia. Over the period from January 1, 2023, to 2024, they contributed more than 171.5 million lari in tax revenues.

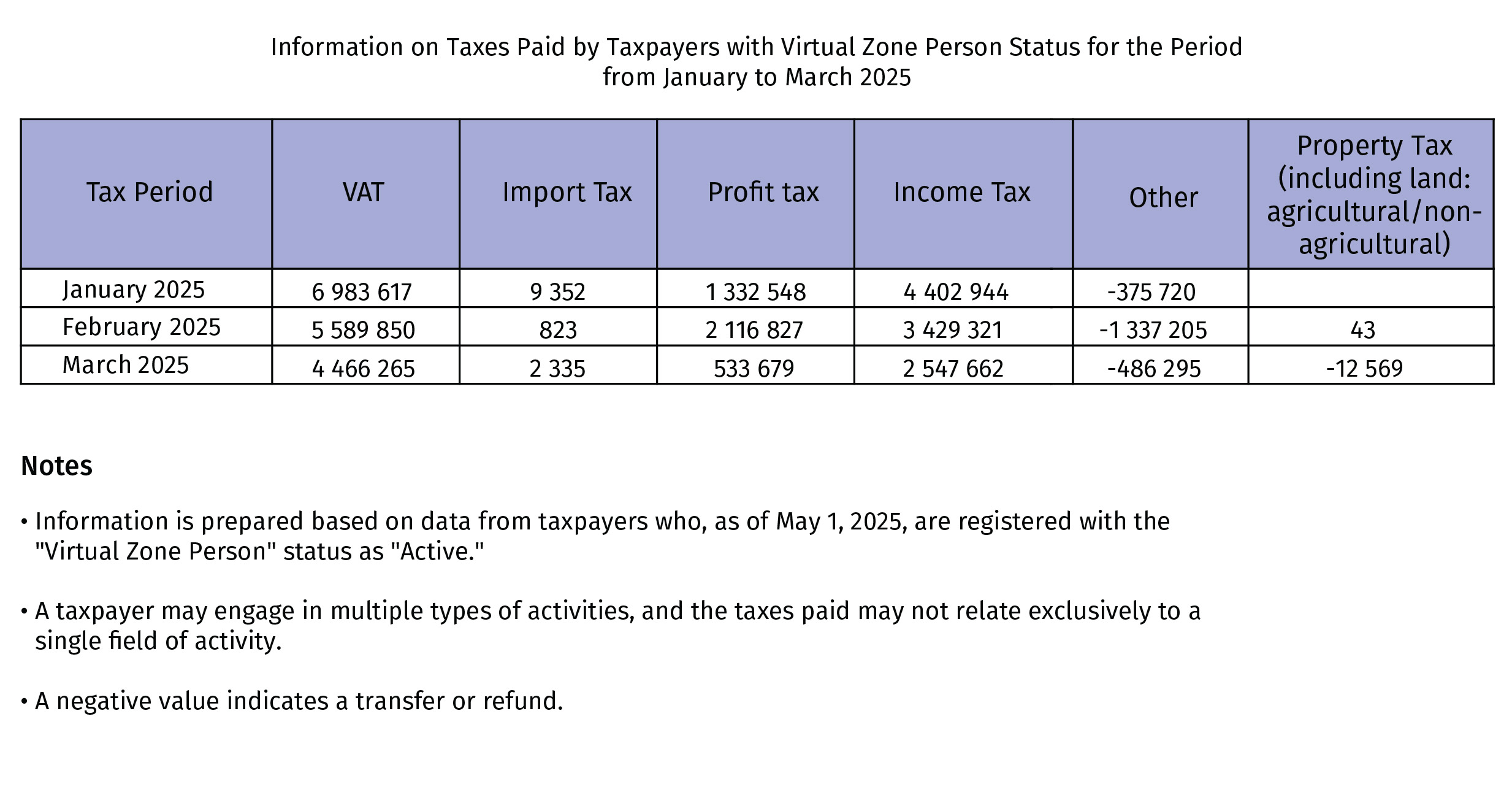

Updated data for 2025 shows:

-

For the first three months of 2025 (January–March), Virtual Zone companies contributed 29,203,478 lari in taxes.

The VAT amounted to 17,039,732 lari — the largest portion of the contribution, reflecting the activity of IT companies on the international market and their confident expansion beyond the country.

The profit tax reached 3,983,054 lari, demonstrating steady business growth and sector stability.

The income tax brought in 10,379,928 lari, underscoring the importance of employment in the sector and the growing role of the Virtual Zone.

It is worth noting the negative values: Other (-2,199,220 lari) and property tax (-12,526 lari), which indicate returns or transfers directly linked to the Virtual Zone’s benefits, emphasizing its advantages.

Summary

Virtual Zone companies contributed more than 171.5 million lari for 2023–2024 and 29,203,478 lari for January–March 2025.

The efforts of the Association have strengthened trust: more and more companies feel that the Virtual Zone status is backed by powerful and reliable support.

The Association of Georgian Virtual Zone Persons continues to strengthen the IT sector, providing support and protecting the interests of companies.

Join us and learn more about the opportunities for your business!

The source of information is the Revenue Service